You are responsible for paying any additional tax liability you may owe. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

TURBOTAX 1040X AMENDMENT HOW TO

You might be wondering how to file an amended return to take advantage of these changes and whether you should. But some of these changes can also retroactively affect taxes from previous filings. Read more…Ĭongress sets the laws that change the current and future rules around taxes.

TURBOTAX 1040X AMENDMENT UPDATE

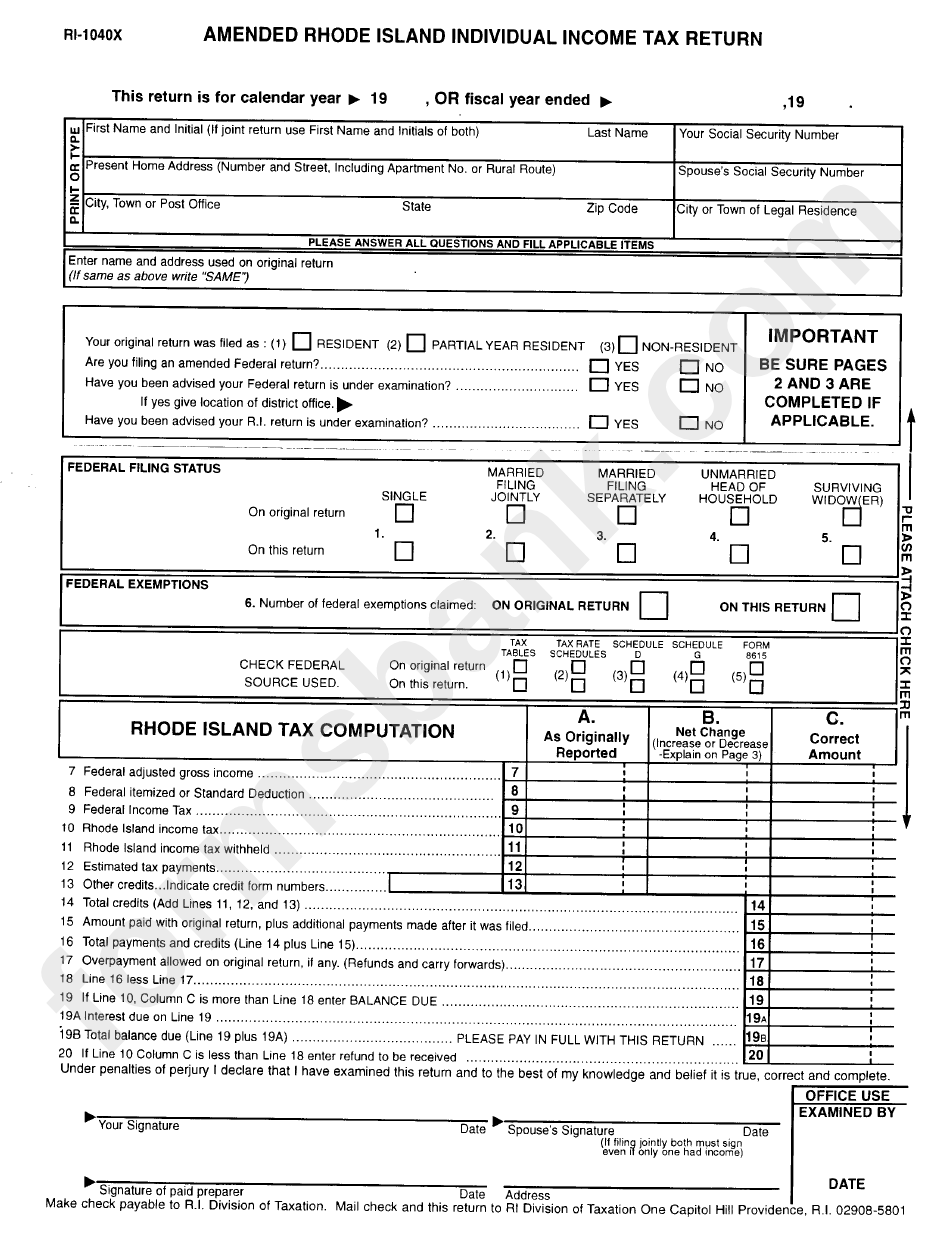

Form 1040-X only requires that you update the numbers that will change. When you prepare the 1040-X, it's not necessary to complete a brand new tax return. If you ever discover an error on a tax return, realize you qualify for deductions or credits you didn't take, or forgot to include some income, you may be able to amend your return by filing a Form 1040-X. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X. Filing an amended tax return with the IRS is a straightforward process. How to File an Amended Tax Return with the IRSĭid you make a mistake on your tax return or realize you missed out on a valuable tax deduction or credit? You can file an amended tax return to make the correction.

However, you have to adhere to all eligibility criteria before filing the amendment. The IRS allows you to voluntarily correct the mistakes you later discover by filing an amended tax return.

TURBOTAX 1040X AMENDMENT CODE

The Internal Revenue Code is lengthy and complex, which can sometimes mean that your personal income tax return includes some errors and omissions. The IRS allows you to correct mistakes on a tax return you've already filed by filing an amended tax return.

0 kommentar(er)

0 kommentar(er)